Growing up, many of us were instructed on the values of saving money and being responsible consumers. Even the best of us, however, tend to forget some of the best ways toexercise excellent frugality, and our bank accounts end up suffering for it.Below are just a few money-saving tips to keep in mind before you head to the checkoutcounter. As you read, you may notice that you knew some of these tips already but just forgot about them.1. Buy used items.We remember to buy used items withsomepurchases, likecars and video games. But we usually forget to shop for used items when looking for clothes, electronics, or even furniture. Obviously, this doesn’t apply to perishable items, but utilizing websites such as Craigslist and social media platforms can leadto huge savings for you.One of my favorite past times isvisiting thrift shops on weekends (even before the song came out) and gauging the prices. When I’m in need of something later on, I know (roughly) how much it’s going for at discount stores.2. Wait a day before you make apurchase.This is crucial for big purchases. Impulse buying is a major contribution to why our bank accounts aren’t where theyshould be, so If you really want to buy something, wait a day or longer and see how you feel then. Chances are that you’ll be less tempted to make the purchase, unless it is somethingyou really need.3. Buy in bulk.The guideline for this is simple: if it’s somethingyou know you’llbe using, like toiletries or food items, then save yourself some money by purchasing in bulk. Toilet paper, tissues, toothpaste, and other essential items are great for bulk because you’ll be saving moneyin the long run without buying things you’ll never use.4. Treat yourself once in a while.The psychology of impulse buying and over-spending is quite complex and interesting, but a lot of it can be curbed by positive reinforcement. Rewarding yourself, sparingly, isa great method for maintaining control of your finances without going overboard. Set rules for yourself, but don’t be afraid to give yourself a break when appropriate.5. Shop around.This is a given for some people,but you may be the type of person who falls in love with thefirst option they see for a purchase. Exercise some financial discipline and visit other stores (or even online) to compare prices and features. You may find that what you were about to drop significant funds for can be found way cheaper, or better, somewhere else.6. Use cash.Credit cards, while gloriously convenient, can be exceptionally deceitful. We tendto use them flippantly, not considering the impact they’re really having on our personal finances. If you use cash, however, your subconscious is more likely to feel the pain fromlosing that money, resulting in a more conscious effort to curb your spending.For big purchases, you might find it worthwhile to use money orders for that same reason, and that will help establish a mentality of preparing your finances before making big decisions. Read full article

Telenor tricks, UFone tricks, Jazz Tricks, Zong Tricks, Warid tricks, Mobile tricks, Computer tricks, Secret Codes

Subscribe to:

Post Comments (Atom)

Top Story

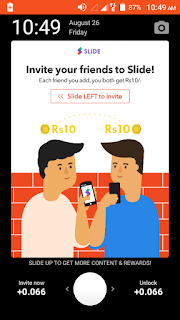

Earn Free Mobile Recharge |Slide App|

Assalam o Alaikum friends! Earn Unlimited Free Recharge using Slide App. We sharing A free Recharge app that will pay Rs.0.066 whenever yo...

-

Details Brand Acer Series CB3-532-C42P Show Size 15.6 Inches Working System Chrome operating system Processor. Cou...

-

How to Crack Ulead Video studio 11 Plus Install Ulead Video studio Plus 11 by running "Setup.exe" file. After installation don...

-

Hot new! download and get free Photoshop CC 2015 Full version (32bit + 64bit) and see how quick to crack Photoshop CC 2015 in steps. To...

No comments:

Post a Comment